McKinsey gets it: why agentic AI will transform financial crime fighting

McKinsey just published research that confirms what we've been seeing at Duna: the compliance industry is ready for AI and change the way we handle compliance.

The numbers are absurd. Banks detect only 2% of global financial crime despite spending hundreds of billions annually and dedicating up to 20% of their workforce to KYC/AML operations.

Traditional AI delivered modest 20% productivity gains. But McKinsey predicts 200 to 2,000% productivity improvements with the use of Agentic AI.

Three waves of AI in compliance

McKinsey breaks down the evolution clearly:

Analytical AI handles tasks like false positive detection and transaction monitoring. Useful, but incremental.

Generative AI supports human investigators by extracting document data, summarizing adverse media, and drafting reports. Better, but still human-dependent.

Agentic AI operates autonomous digital factories where AI agents collaborate on end-to-end tasks. Humans focus only on exceptions, oversight, and coaching. Game-changing.

The difference is big. While analytical and generative AI support humans in their existing roles - 15 to 20% productivity gains - agentic AI fundamentally shifts the operating model. Instead of humans doing the work with AI assistance, humans can manage AI agents that do the work autonomously. One compliance manager can oversee 20+ AI agents, each handling complete end-to-end processes. This changes the work completely, and is the reason why McKinsey is bullish on 200 to 2000% improvement in efficiency.

At Duna we already see strong improvements at our customers and early signs of agentic AI at work, with 4.8x efficiency gains and more automations (higher straight-through-processing).

Why now?

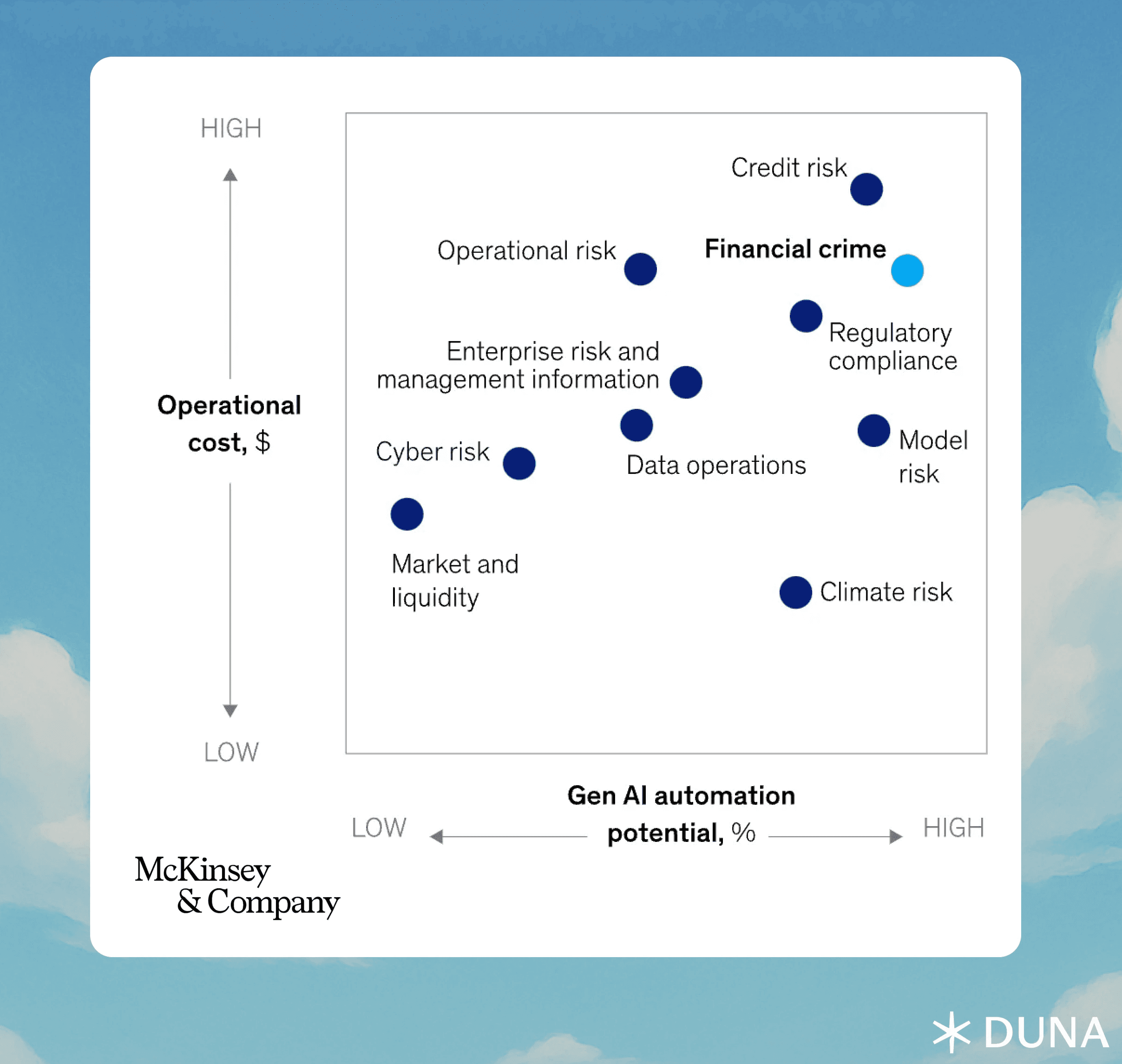

McKinsey identifies the perfect storm: high operational costs meet advanced AI automation potential. Banks commonly assign 10-15% of full-time employees to KYC/AML alone while automation rates remain low due to fragmented data and unstandardized processes.

The solution isn't just better technology. It requires rewiring entire domains, clear agent roles that mirror human teams, and operating models focused on validation rather than execution.

The prerequisites

Success demands more than deploying AI tools:

Clear, repeatable processes before automation

Strong guardrails and QA frameworks

Full explainability of AI decisions

Comprehensive change management

The most important element is proving strong ROI metrics. Customers demand immediate returns with short payback times. The impact needs to be transformational, not incremental — big improvements that justify the investment and organizational change.

McKinsey emphasizes that adoption takes twice as long as building the technology. Leading institutions start with pilot perimeters, prove impact, then scale systematically.

The Duna perspective

This research validates our approach of building AI-native compliance infrastructure from the ground up. While point solutions add incremental value, agentic systems deliver transformational impact.

The companies that invest early in end-to-end AI automation will gain decisive competitive advantages. Those that wait risk falling further behind in an increasingly automated compliance landscape.

McKinsey's research shows the path forward. The question isn't whether agentic AI will transform financial crime fighting — it's how quickly institutions will adopt it.

Read the full McKinsey report: "How agentic AI can change the way banks fight financial crime"

Want to see AI in action? Learn how Duna helps leading financial institutions achieve 4.8x efficiency gains at duna.com

About Duna

Duna’s mission is to build global trust infrastructure by providing a digital passport for every business. Over time, this will evolve into a network for shareable identity and one-click onboarding.

Today, Duna is an AI-native business identity platform for regulated companies including large banks, fintechs, platforms and financial institutions. Duna enables organizations to understand who they are doing business with through “know your customer” (KYC), “know your business” (KYB), “customer due diligence” (CDD), and “anti-money laundering” (AML).

Duna is backed by Index Ventures and CapitalG, as well as an exceptional group of tech executives from Stripe, Adyen, Anthropic, and Goldman Sachs – including Pieter van der Does (Adyen founder; advisor), Claire Hughes Johnson (Stripe COO), Frank Slootman (Snowflake Chairman), and many more.